7 Aspects of Our Lives Revolutionized by Fin-Tech

Fin-tech is a term which conveys the inevitable marriage of finance and tech. It also serves as a convenient handle for the technological revolution happening in financial services today. The changes we see in payments, insurance, lending, deposits and funding, however, are not limited to sheer convenience. The ultimate goal is also to make transactions much faster, cheaper and, most importantly, more secure for everyone.

Fin-tech is a term which conveys the inevitable marriage of finance and tech. It also serves as a convenient handle for the technological revolution happening in financial services today. The changes we see in payments, insurance, lending, deposits and funding, however, are not limited to sheer convenience. The ultimate goal is also to make transactions much faster, cheaper and, most importantly, more secure for everyone.

But what is all this fuss about? Imagine a world in which you never have to type your credit card number again, and all your payments are fast and secure. Imagine a world in which complex algorithms constantly monitor market events to automatically analyse and rebalance your investments and savings portfolio so you don’t have to.

Imagine a world in which your startup, in its early development stage, is directly funded by investors, whom you do not even have to meet face to face. Imagine a world in which people no longer use banks to lend and borrow money, and all they need is a platform connecting lenders and borrowers.

It is not all science-fiction. Imagine it’s happening today (in case you just failed to notice). The revolution is here, making our lives easier. Read on to get to the nitty gritty of fin-tech revolution and find out what it has brought to the table.

Online payments

When talking about fin-tech, it is impossible not to mention online payments. The process of paying for that pair of sneakers you bought online has become a little less of a pain due to services provided by companies like Square or PayPal (rings a bell, right?). E-commerce, after all, is where it all started. Mass adoption of mobile phones and the advent of online stores gave birth to the much needed fast online payments. The term online payment encompasses both the elements of the payment process visible to the naked eye when you pay, and everything else happening “under the hood” which you don’t see.

Online payments is a frontier of fin-tech which is the playing field for some of the biggest brands of the industry, including PayPal, Apple Pay, Stripe, Venmo, and Square. Competition in this sector is considerable, but also very welcome, resulting in lower fees for consumers and businesses wanting to implement online payments on their websites.

Under the hood, online payments involve a simple, predictable and secure settlement system, which, with the coming of fin-tech revolution, has become faster than ever… and is about to get even faster very, very soon.

So, how does it really work? Typically, when a sum of money is transferred, automated clearinghouse exchanges messages between the sending and receiving banks, confirming that the value has been transferred before any money physically changes hands. The result? While the actual settlement process between banks may take up to several days, for the end users the payment is virtually unnoticeable, and the purchase takes mere seconds.

Affordable international transfers

Platforms like TransferWise offer a fast, reliable affordable way to send money abroad. The main advantage, compared to traditional methods of cross-currency money transfers, is its incredible transparency in terms of cost. In TransferWise, there are no hidden charges like additional fees on top of exchange rates. Unlike a bank, the service allows users to check all applicable fees upfront, before currency conversion takes place and money changes hands.

TransferWise can bypass horrendous international transfer fees imposed by banks, allowing for more affordable international money transfers. How is this even possible? It is all about a really smart algorithm. The idea is quite simple: instead of making one international transfer, two local transfers are made, allowing to avoid cross-country transfers and thus bypass unnecessary cost. Rather than transferring the sender's money directly to the recipient’s account abroad, TransferWise routes the money to the recipient of another transfer going in the opposite direction. Conversely, the recipient of the transfer receives a payment not from the actual sender initiating the transfer, but from the sender of the equivalent transfer in the opposite direction. This is how it works under the hood, but makes no visible difference to the user of the service.

Smart investments

With the right technology on your side, you can manage your money like a champ, even if you are a young investor with zero business savvy. All you need to do is sign up to a platforms like Betterment or Wealthfront and never pay for human (i.e. fallible) investment counsellor again.

How does it work? There are algorithms in place adjusting to the owner of the portfolio—based on the personal information like age, assets, readiness to take risk, and various other factors, the platform selects optimal set of stocks and bonds. Replacing human financial advisers with algorithms allows to significantly reduce the fees, which currently stand low at just about 0.25% for Betterment and 0.15% for Wealthfront. Depending on the plan you choose, you can also jump into a video call with a flesh-and-blood adviser if you really feel like it.

Robo-advisers are no marketing gimmick or a temporary fad. They are the next big thing happening as a part of the fin-tech revolution. What entices people to give it a shot is the simplicity and transparent fee structure.

Robo-adviser newcomers still trail behind traditional banks and traditional asset managers in terms of combined assets, with less than $20 billion under robo management compared to the massive $17 trillion for traditional managers (yes, that’s a trillion). But importance of this sector of fin-tech can not be underestimated, as this number is said to double every couple of months, which cannot be said for the traditional asset management market.

Unpaid invoices? No problem!

Fin-tech revolution has decentralised the financial market and spurred a wave of peer-to-peer lending businesses. It is now possible to lend money to people or businesses using online services that match lenders directly with borrowers. MarketInvoice (now Kriya) was born on the wave of the revolution. The idea behind the service is a modification of the peer-to-peer lending model for invoice financing, allowing companies to “borrow” money against their unpaid invoices, for a small fee. This allows businesses to get future payments immediately, improving their cash flow.

Having to wait for months on end for a client to pay your outstanding invoice is a strain on every small business, often putting it at the risk of insolvency. MarketInvoice (now Kriya) is a smart service which helps small and medium-sized businesses to unlock these “frozen” funds from all unpaid invoices and convert them into working capital. The platform allows companies to trade outstanding invoices with investors who advance cash against these future payments in exchange for a fee. To date, the company has “unlocked” over £500 million in outstanding invoices, and that’s for UK businesses alone.

Crowdfunding

Taking a traditional bank loan to fund your next business idea is a process that may take ages. This, combined with very limited options banks actually have for small businesses seeking initial capital gave birth to a new, dynamic form of funding. Today, instead of resorting to interest-hungry venture capitalists or jaded investors, you can try equity crowdfunding sites, like Seedrs and AngelList. Bottom line? Almost everyone can be an investor and, perhaps more importantly, the investors are now more likely to be people just like you, genuinely passionate about your idea or product (maybe because they want to own one), rather than business people interested in the profit it can potentially yield.

In 2014 over $16 billion was raised in crowdfunding capital worldwide. This number doubled in 2015, and is estimated to increase even more in 2017. There are currently dozens of popular crowdfunding websites, and each serves a slightly different purpose—while some of them are strictly business-oriented, sites like GoFundMe enable people to raise money for important life events like graduations, or difficult circumstances such as accidents and illnesses.

Market regulators may be sceptical about the idea of crowdfunding and the risk of fraud that it entails. And rightly so! Individual investors may not have the business acumen to understand all the dangers associated with even the most lucrative seed-stage investments. And yes, it is also true that the ability of an average internet user to spot a real investment opportunity and immediately dismiss scam is quite poor… but this is partly what makes crowdfunding so beautiful and exciting. Crowdfunding, in essence, is just the extension of the idea of internet, and giving people the freedom, the power to discuss, create, decide and promote things as they feel fit. The difference: it involves money being put on the table.

Lending and borrowing money

In some respects fin-tech is being revolutionized by entrepreneurs for entrepreneurs, helping small businesses grow faster. Thanks to the fin-tech revolution you can get your next business loan from sites like Lending Club, OnDeck, or Kabbage. Marketplace lenders are quickly filling a void in the area of small business lending often neglected by big banks.

Platforms like Lending Club (there are dozens of similar country-specific websites) are designed to connect lenders and borrowers and allow lending money with narrower spreads than those offered by retail banks. These platforms are particularly appealing for the lenders because they offer incredible freedom of choice in terms of risk and interest.

For borrowers, on the other hand, loan decisions are faster than in traditional banks, and the rates are more favorable. While traditional banks take days to weeks to make a decision on a business loan application, applicants for a loan simply fill out an online form and can get an instant decision based on a sophisticated algorithms analysing their creditworthiness.

Oh… how about we forget the concept of money altogether?

The rise of fin-tech may be the death knell for physical money or money as we know it. And this is not only because we find it more convenient to manage bigger sums of money online rather than offline. The revolution gave birth to digital-currency options, with platforms like Coinbase, Circle, and the like. What we are witnessing is the inevitable integration of the finance and banking sector with the cloud, and a progressing decentralisation of the financial market. Again, giving more control to the people. Transactions in virtual currencies are said to be cheaper, faster, more secure and more transparent. But on top of all that, they transcend borders and are independent of exchange rate differences.

Virtual currency is a concept allowing for "a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat currency, but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically".

Although virtual currency like Bitcoin used to be associated with illegal activities like money laundering, experts say it is actually better suited to help crime detection. Platforms like Bitcoin are no longer underground hacker-specific communities. Virtual currencies are becoming internationally recognised and embraced by big, respectable companies, in compliance with existing regulation.

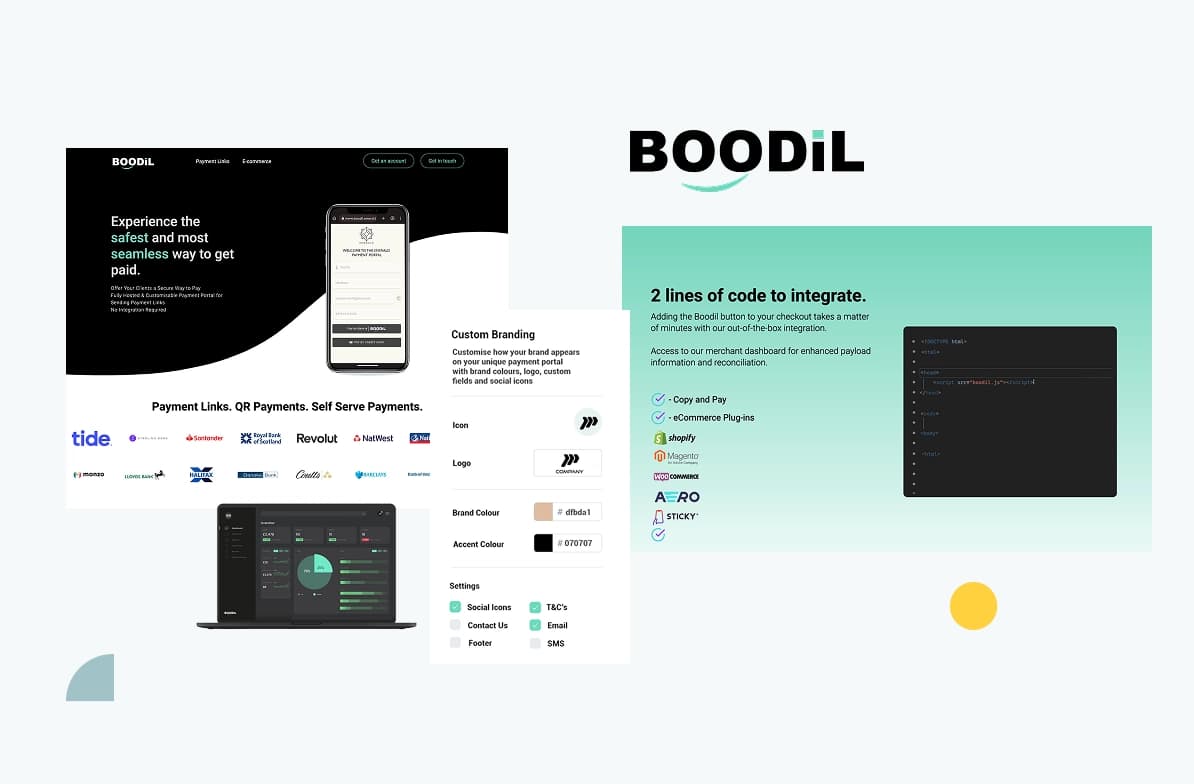

We built a secure Shopify payment app for Boodil that transformed them from a standalone payment processor into an approved Shopify partner, unlocking access to 3.5+ million stores across multiple markets.

3.5M+

stores unlocked

Multi-market

expansion

Shopify

payment integration

Conclusion

FinTech is not just a fashionable term or an outbreak of empty hype started by a bunch of startups. It is here to stay, and as we speak, the solutions it brings are revolutionizing every conceivable aspect of finance and banking.

The only thing hampering the growth for such companies (and thus delaying the bona-fide fin-tech revolution) are conservative regulators, still wary of the risks and consequences, putting caps on the various aspects of emerging fin-tech services.

Yes, this is uncharted territory and a lot of work needs to be done to ensure security of online payments, marketplace lending, finance management or crowdfunding. It will also take long to establish uniform standards. But who knows, maybe in five years today’s startups will have joined — or completely displaced —the banks as providers of financial services? Such scenario is not completely unlikely.

We have already successfully embraced some parts of the revolution like online payments and crowdfunding. Possibilities of fin-tech are endless, and we should be expecting big things to come in the foreseeable future.

Let’s Create a Great Website Together

We'll shape your web platform the way you win it!

More posts in this category

September 05, 2022 • 12 min read

READ MOREGreenfield vs Brownfield IT Projects: Key Differences, Costs and Risks

Starting a project from scratch or taking an already started one – this is what the greenfield vs brownfield question is mainly about. It brings, however, a few important issues. How to run such projects? Which approach is better for your needs? What does the development process look like? Check the answers below.

April 23, 2020 • 9 min read

READ MORE11 Most Promising Startups In San Diego To Watch In 2020

When you say ‘startup’, most people think about California. And while many jump directly to San Francisco, we took a look at San Diego. Startups there spring up like mushrooms, and when we were around, we decided to meet some companies operating there. Conclusions? San Diego really is an awesome (but often overlooked) place to scale-up your idea or business!

March 25, 2020 • 11 min read

READ MORECOVID-2019 vs e-commerce - common problems & how to face them

COVID-19 coronavirus is officially a global pandemic. As it’s spreading around the world at a fast pace, it is predicted to take its toll on both people and businesses, including the e-commerce industry.